Tariffs and the Economy: What Business Owners Should Do Now

Tariffs and the economy are hot topics right now. Economic indicators are mixed. Whether we’re heading into a recession or continuing in a strong market,

Tariffs and the economy are hot topics right now. Economic indicators are mixed. Whether we’re heading into a recession or continuing in a strong market,

When January hits we are focused on our goals for the year. Small business owners often find themselves planning the direction and initiatives for the

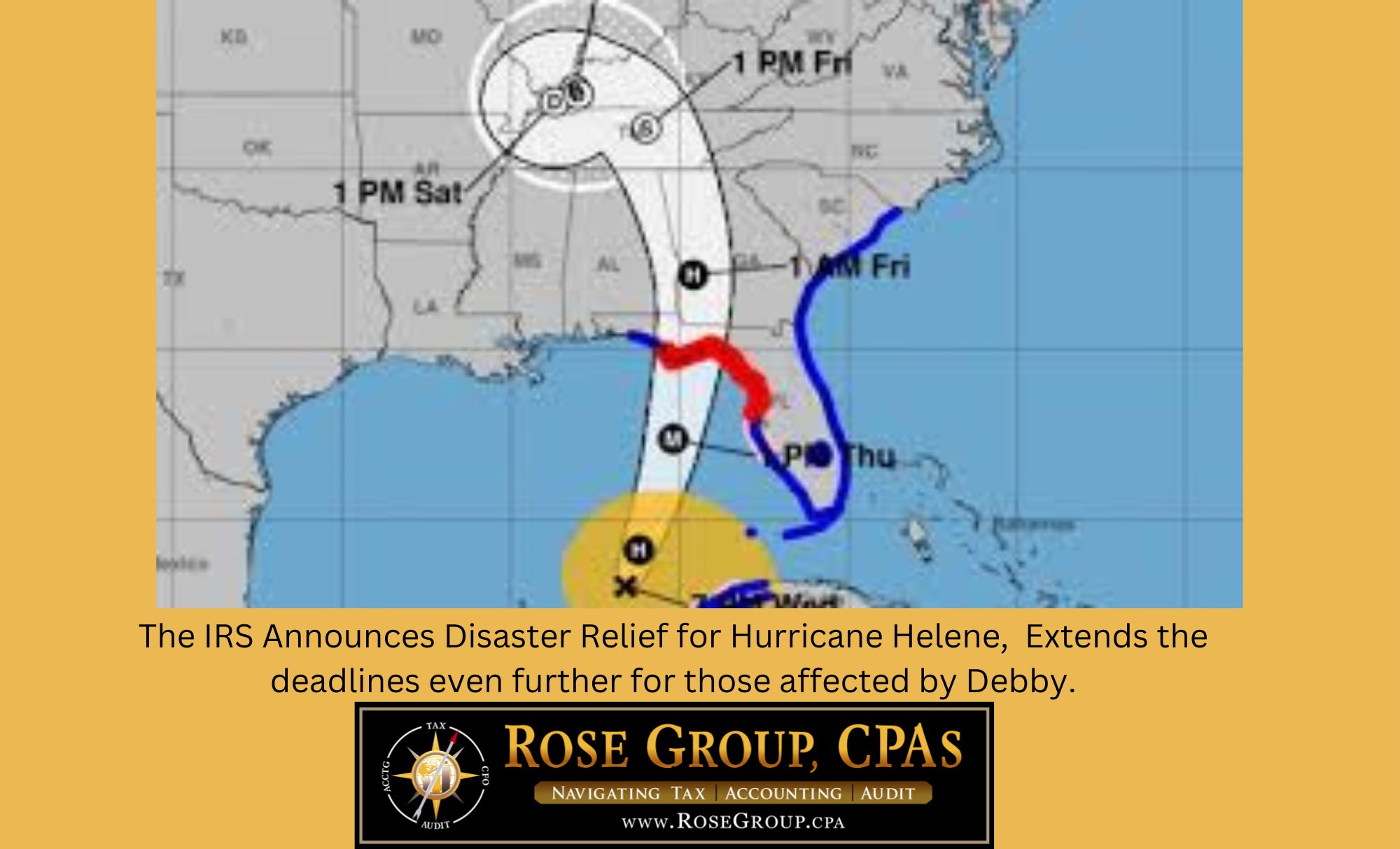

If you’ve been impacted by a hurricane, like Hurricane Debby or the more recent Hurricane Helene, I want to make sure you’re aware of the tax relief that’s available to help ease some of the burden during this difficult time.

s Baby Boomers approach retirement, many small business owners are beginning to plan their exits, creating what’s being called the “silver tsunami.” For Millennials and Gen Z, this presents a “golden opportunity” to acquire established businesses.

Suspended losses in an #S-corporation arise when a shareholder’s losses exceed their basis in the corporation. These are the losses you couldn’t deduct in previous years because they exceeded your basis and the loses were carried forward. Now that you’re winding the operations down, it’s important to know how to handle them.

United States launch process requires obtaining an Employer Identification Number (EIN). This unique identifier is essential for tax and payroll reporting, and U.S. banks typically require one to establish accounts.

Understanding tax implications to avoid potential penalties and ensure compliance with tax laws is necessary for onboarding employees. State tax withholding is required in the state the employee resides. You, as the employer, will also be required to establish and pay state unemployment tax in that state.

When you first became eligible to participate in your employer’s retirement plan, you were asked to complete beneficiary information. While this choice may seem straightforward, there are complexities to IRA beneficiary designations and implications to your estate planning.

One test the IRS looks at in determining if a business has a profit motive or is a hobby, is if it is run like a business. Does the activity have a separate banking account. Separating personal and business finances is a basic financial management practice.

Employment classifications, the distinction between employees and independent contractors, is not governed by the application of rules. The implications of how a worker is classified

120 Mosaic Boulevard,

Suite 200

Pittsboro, NC 27312

ERO@RoseGroup.cpa

919-913-8081

101 Cosgrove Ave,

Suite 260

Chapel Hill, NC 27514

Admin@RoseGroup.cpa

919-913-8081

3119-A Crawfordville Highway,

Crawfordville, FL 32327

Info@RoseGroup.cpa

850-759-5080