Tax season is stressful for many, especially if you’re worried about penalties. Either as an individual or a small business owner, IRS penalties can be significant, turning a simple oversight into a costly mistake. When are penalties assessed and how are they calculated?

The IRS imposes a variety of penalties including not withholding enough income tax during the year, filing late, paying late, and mistakes that understate the tax liability.

Estimated Tax Penalty

Small business owners and self-employed individuals are required to make quarterly estimated tax payments. If you fail to pay enough taxes throughout the year, the IRS may assess an underpayment penalty. This applies to those who don’t have sufficient withholding or don’t pay enough in quarterly estimated taxes.

Late Filing Penalty

The late filing penalty is one of the most frequent issues taxpayers encounter. If you fail to file your tax return by the due date (or extended due date), the IRS penalty is 5% of the unpaid taxes for each month your return is late, up to a maximum of 25%. If more than 60 days pass without filing, the minimum penalty is either $435 or 100% of the unpaid tax—whichever is less.

Late Payment Penalty

If you file your taxes on time but fail to pay the taxes you owe, the IRS charges a late payment penalty. This penalty is 0.5% of the unpaid taxes for each month or part of a month that the tax remains unpaid, up to a maximum of 25%.

We recommend filing your return on time and paying what you can to reduce additional penalties. You may also qualify for a payment plan to limit the amount of additional penalties assessed.

Accuracy-Related Penalty

The IRS imposes an accuracy-related penalty when taxpayers understate their income by a significant amount or claim deductions or credits they’re not entitled to. This penalty is typically 20% of the underpaid tax. In some cases, the IRS may charge this penalty if they determine that the taxpayer was negligent or didn’t have a reasonable basis for their tax position.

Failure to Deposit Employment Taxes

For businesses that withhold payroll taxes from employees, failure to deposit those taxes with the IRS can result in significant penalties. The IRS charges a penalty based on how late the deposit is, ranging from 2% to 15% of the unpaid amount.

What Triggers These Penalties?

IRS penalties are typically triggered by mistakes, missed deadlines, or lack of compliance. Some common reasons penalties are imposed include:

- Missing filing deadlines for individual, corporate, or payroll tax returns.

- Failure to pay the taxes owed by the due date, even if the tax return is filed.

- Inaccurate reporting of income or expenses on tax returns.

- Underpaying taxes throughout the year (especially for self-employed individuals).

- Neglecting payroll tax obligations is a serious concern for small businesses.

Remember an extension of time to file is not an extension to pay. The failure to file penalty will not be assessed for a timely filed return by the extended due date; but, penalties will be assessed for any underpayment. At Rose Group CPAs we will estimate the tax due at time of extension based on a combination of information provided and information from the prior year return.

How to Avoid IRS Penalties

Avoiding IRS penalties is all about staying organized, filing on time, and ensuring accuracy in your tax reporting. Here are a few tips to help you avoid penalties:

- File and Pay on Time: Make it a priority to file your tax return by the due date and pay as much of the tax you owe as possible. Even if you can’t pay in full, filing on time will help minimize penalties.

- Set Up a Payment Plan: If you can’t pay your full tax bill, contact the IRS to arrange a payment plan. This can prevent additional penalties from accumulating.

- Accurate Record Keeping: Keep detailed and organized records throughout the year. Accurate records will help ensure you don’t miss deductions or make reporting errors that could trigger an accuracy-related penalty.

- Pay Estimated Taxes: If you’re self-employed or have income not subject to withholding, make sure you pay quarterly estimated taxes. This helps avoid the underpayment penalty.

- Stay Compliant with Payroll Taxes: If you run a business, make sure you’re depositing payroll taxes on time and following the IRS’s requirements for employee withholding.

How to Contest or Mitigate IRS Penalties

If you’ve already been hit with a penalty, all is not lost. The IRS does provide options for contesting or reducing penalties under certain circumstances. Here’s how:

- Request a Penalty Abatement: In some cases, you may be eligible for a first-time penalty abatement. This is available if you have a clean filing history and haven’t had a penalty in the past three years.

- Show Reasonable Cause: If you can demonstrate that your failure to file or pay was due to reasonable cause (such as illness, a natural disaster, or an unavoidable absence), the IRS may waive the penalty.

- Submit an Offer in Compromise: If you’re facing significant financial hardship and can’t pay your tax bill in full, you may be eligible to settle your tax debt for less than the full amount owed through an Offer in Compromise.

- Seek Professional Help: Sometimes penalties are the result of more complex tax issues. Working with a tax professional can help you understand your options and develop a strategy for contesting or reducing penalties.

Don’t Let Penalties Add Up

IRS penalties can quickly turn a small tax issue into a large financial burden. The best way to avoid penalties is to stay organized, file on time, and ensure you’re paying what you owe.

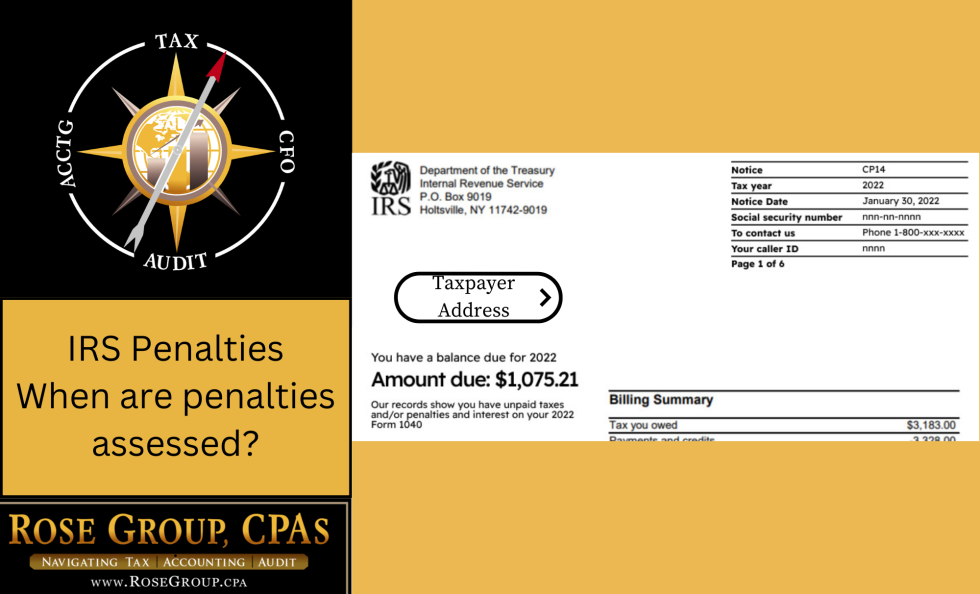

Penalty Notice

Rose Group CPAs recommend you pay the penalty notice by the due date and contact your CPA for a reconciliation. Most CPAs will calculate penalties to a certain date as a curtesy. Then the IRS will assess the amount due. The taxpayer is responsible for accurate filing so the review of the completed return is an important step in the process.